Sustainability

The future of investing, is sustainable.

Sustainable businesses can offer better long-term returns, with less risk.

It’s clear that issues like climate change, biodiversity loss and social inequality pose a serious threat to long-term economic growth.

But there is hope, as the situation is inspiring innovation and adaptation in technology and business processes, and it’s all focussed on having positive social and environmental impacts.

The transition to sustainable economies represents a huge investment opportunity.

Our deep commitment to sustainability

We aim to identify companies that will not only benefit from the sustainable development of our economies, but those who are also contributing to it.

We aim to identify companies that will not only benefit from the sustainable development of our economies, but those who are also contributing to it.

We integrate ESG issues into all of our investment decision making, but we go further.

Sustainable Investing is about identifying the companies that have a long-term vision for how we can make the world a better place through positive disruption.

We identify the most sustainable companies

Sustainability is our competitive advantage.

Our screening processes have always looked beyond just financial data.

We use a range of methods to identify the best performing companies, to filter out the lagards, and to influence management once we’re invested.

These methods include:

- Low fossil fuel exposure

- ESG Integration

- Negative Screens

- Positive Screens

- Measurement of SDG Impacts

- Engagement

Low Fossil Fuel Exposure

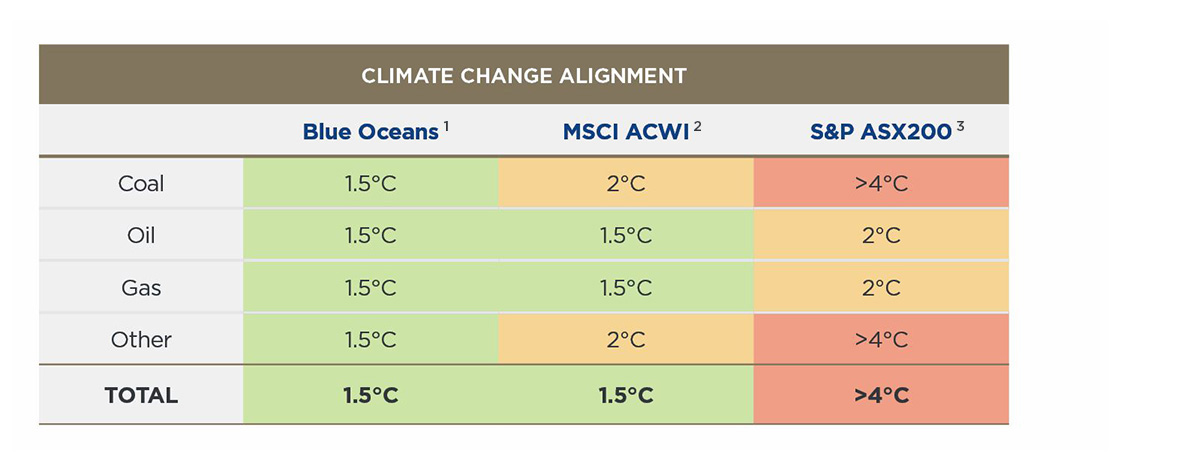

By ensuring our portfolio has a low level of fossil fuel exposure, we contribute to the goal of keeping global warming to less than 1.5°C (as urged by the Paris Climate Agreement and the IPCC).

Through investing in future-focussed companies, and avoiding those who produce or consume fossil fuels, we’ve developed a portfolio that is dramatically less carbon intensive than mainstream funds.

Table 1: Blue Oceans Capital – Wholesale Portfolio, alignment to the Paris Agreement

Source 1: Sustainable Platform 07/12/2020 / Source 2: MSCI benchmark data / Source 3: S&P benchmark data

ESG Integration

Our financial analysis is exhaustive, but we also assess a range of environmental, social and governance (ESG) factors to give us a complete picture of the risks and opportunities surrounding a company. It helps to inform our decision-making process across the phases of screening, stock selection and portfolio construction.

We use a bottom-up approach to researching companies, and that includes ESG Integration.

Our ESG Philosophy

We recognise that sustainable environmental practices are vital to support a prosperous economy.

An inclusive society will allow more people to participate in the economy, to drive vibrant markets and in-turn, to healthier investment returns.

Good governance is founded on honesty and ethical behaviour, and long-term sustainability is only possible when markets operate with fairness and respect.

Negative Screens

We don’t invest in:

- Fossil fuels (Mining, production and intensive usage)

- Animal Cruelty

- Ocean Exploitation

- Deforestation

- Gambling

- Alcohol

- Tobacco

- Controversial Weapons

A selection of our Positive Screens

We do invest in:

- Battery technology

- Renewable energy production, and related technology

- Healthcare

- Artificial intelligence

- Low-cost and innovative financial services

- Sustainable agriculture

- Business efficiency platforms

Our approach to ESG

Sustainability is our competitive advantage

We assess companies from all angles. We go beyond financial factors to assess the Environmental, Social and Governance (ESG) factors that are relevant to specific companies. This gives us a 360 degree view of the risk and opportunities of a business.

Our Responsible Investment Philosophy

We recognise that sustainable environmental practices are vital to support a prosperous economy.

An inclusive society will allow more people to participate in the economy, to drive vibrant markets and in-turn, to healthier investment returns.

Good governance is founded on honesty and ethical behaviour, and long-term sustainability is only possible when markets operate with fairness and respect.

We do invest in:

(A selection of our Positive Screens)

- Battery technology

- Renewable energy production, and related technology

- Healthcare

- Artificial intelligence

- Low-cost and innovative financial services

- Sustainable agriculture

- Business efficiency platforms

We don’t invest in:

(Negative Screens)

- Polluting commodities (such as oil, coal, copper or gold)

- Weapons or defence

- Gambling

- Alcohol and tobacco

- Any media harmful to psychological well-being

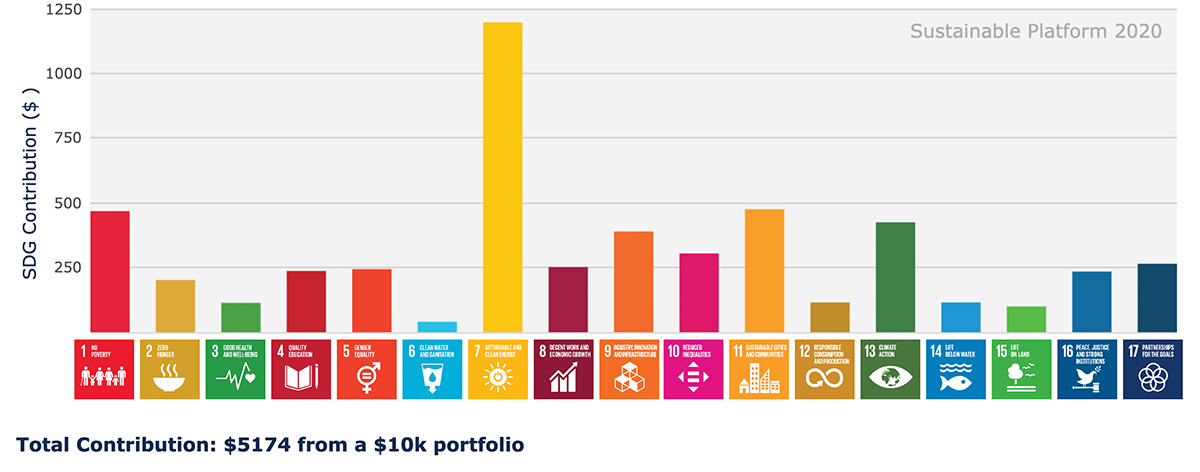

Our impact – The Sustainable Development Goals

We’ve always ensured the companies we invest in aren’t having negative impacts on people or the planet, but we wanted to go further.

We also want to measure the positive impacts our investments are having on the world, and to then use this methodology to identify and assess high-impact companies to be added to the portfolio.

We see The Sustainable Development Goals (SDGs) as an ideal framework with which to assess the positive outcomes flowing from the products and operations of a company.

What are the SDGs? The SDGs represent the greatest challenges facing our world. The 17 goals were established by the United Nations in 2015, and agreed to by all of the 193 member countries of the UN.

We utilise the data system of Sustainable Platform to measure the positive impacts the companies we invest in are having on the world.

Company engagement on sustainability issues

We feel all investors have a duty to be responsible stewards of company equity. We work with companies to ensure they’re managing any material sustainability risks, while also helping them identify opportunities and maximise their potential.

We feel all investors have a duty to be responsible stewards of company equity. We work with companies to ensure they’re managing any material sustainability risks, while also helping them identify opportunities and maximise their potential.

For us engagement is not adversarial, it is a partnership. We open lines of communication to ensure both parties have all the relevant information. We make our concerns known, and we offer advice, recommendations and any assistance that can help the company get back on track.

Company engagement on sustainability issues

We feel all investors have a duty to be responsible stewards of company equity. We work with companies to ensure they’re managing any material sustainability risks, while also helping them identify opportunities and maximise their potential.

We feel all investors have a duty to be responsible stewards of company equity. We work with companies to ensure they’re managing any material sustainability risks, while also helping them identify opportunities and maximise their potential.

For us engagement is not adversarial, it is a partnership. We open lines of communication to ensure both parties have all the relevant information. We make our concerns known, and we offer advice, recommendations and any assistance that can help the company get back on track.

Membership and global advocacy

We are committed to a process of continuous improvement in our approach to sustainable investment.

A key part of this is leveraging our memberships with both the UN supported Principles for Responsible Investment (PRI) and Responsible Investment Association of Australia (RIAA). This helps us to:

- Improve our method of sustainable analysis (sources of data, key metrics, risk identification)

- To engage with the wider investment community contributing to the sustainability discussion and progression of sustainable investment as a mainstream practice

- Define out commitment to being active participants in the global journey towards responsible investment.

Company Case Studies

Presented below are a series of case studies outlining our Environmental, Social, and Governance analysis on some of our company research and also Facebook, a company we removed due to ESG concerns.

SolarEdge – One of the worlds largest and most innovative solar panel and inverter manufacturers. Solar edge in actively transitioning the world towards sustainable energy usage.

The Trade Desk – An independent media buying platform that has scaled to a size where it is actively challenging the dominance of Google and Facebook by offering a completely unbiased, transparent service that protects the privacy of the consumer.

Appen – Human-annotated datasets for machine learning and artificial intelligence deployed by some of the world’s biggest companies and governments. Appen is enabling artificial intelligence that, when applied ethically, can help to accomplish many of the UN Sustainable Development Goals (Vinuesa, et al., 2020).

Adyen – A single solution payment gateway, fraud protection, data capture and reporting tool for merchants. Adyen improves society by enabling omnicommerce, reducing or eliminating the potential for fraud, and creating greater business efficiency.

Paycom – Efficient human management tool. Paycom allows employees to manage their own onboarding and training which greatly improves their efficiency and engagement. Cost savings to the business can be redistributed to innovation that drives greater employment and social benefits (Malloy, 2012; Martin & Kemper, 2012).

Facebook – ESG analysis uncovered critical social issues inherent in social media and failures by management of Facebook that forced us to exit a position we had held for some time.